Immediate Financing Arrangement

An Immediate Financing Arrangement (commonly known as an IFA) is a financial planning strategy which combines life insurance coverage with tax-advantaged wealth accumulation.

Who Could Benefit From an Immediate Financing Arrangement?

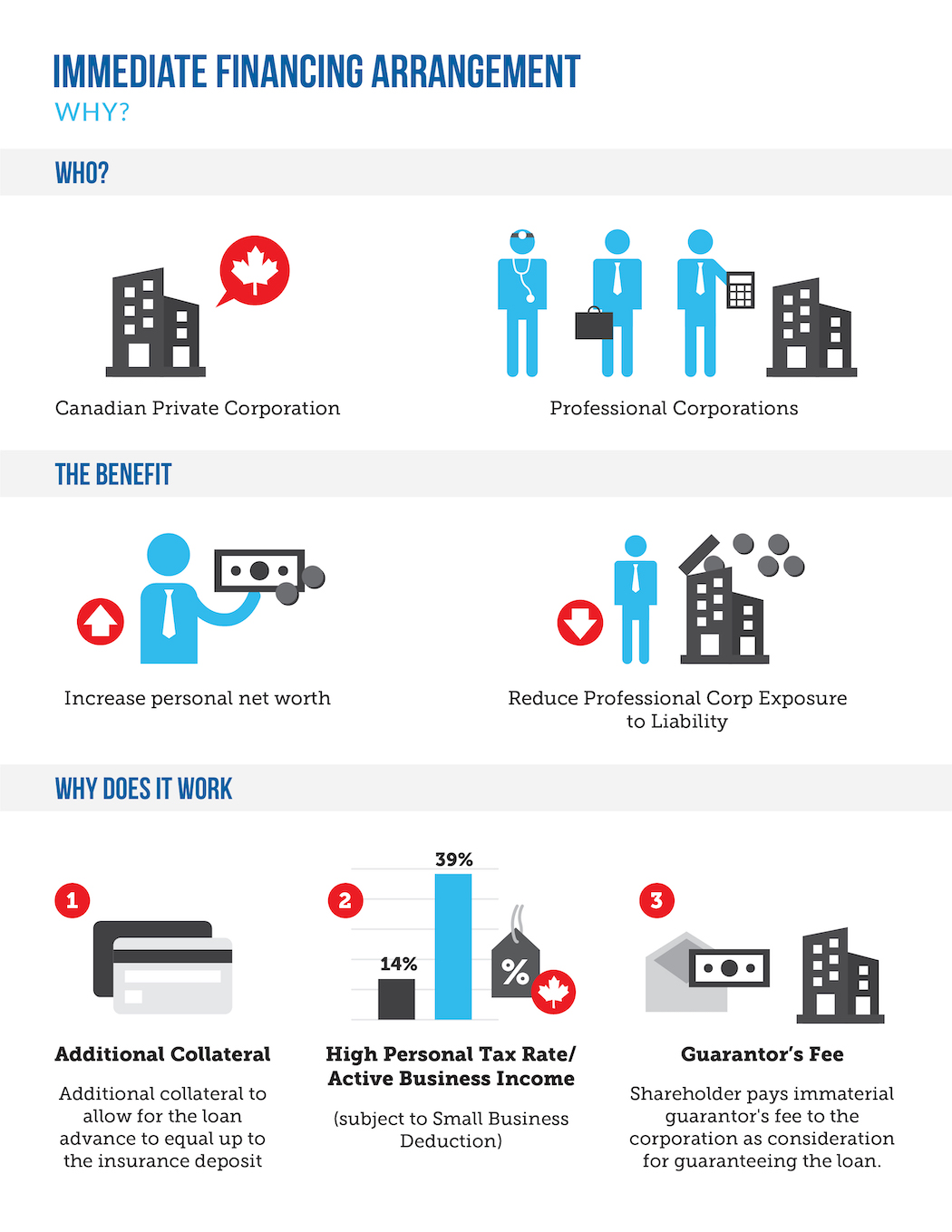

An IFA (Immediate Financing Arrangement) is a financial strategy which serves a particular purpose and, as such, isn’t suitable for everybody. Affluent individuals with a high net worth or business owners of a private corporation that have steady and stable cash flows could potentially benefit from an IFA. An IFA may be suitable if they are seeking permanent life insurance coverage, do not want to jeopardize the use of their working/investment capital, and/or are paying (and/or expecting to pay in the future) income tax at the highest rate.

How Does an Immediate Financing Arrangement Work?

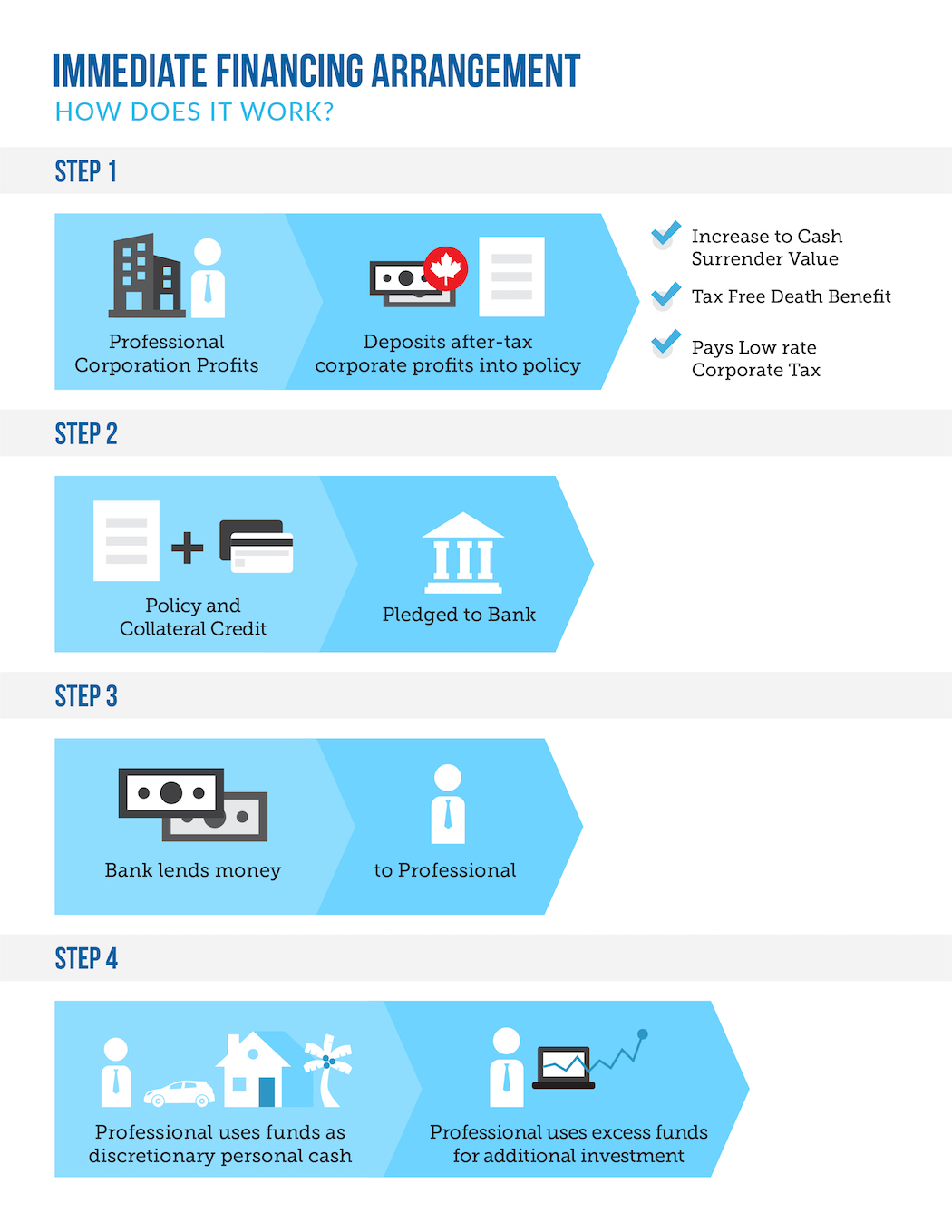

There is a particular process that should be followed in order to get the most from this estate planning strategy:

- An individual or company buys a cash value permanent life insurance policy, contributing the maximum premiums permitted by the policy

- This policy is pledged as collateral to a bank in exchange for a loan

- The individual/company must pay the loan interest

- The individual/company can then use the leveraged funds to reinvest into their business or to invest

Upon the death of the policyholder, the loan is paid off by the payout from the life insurance policy and the policyholder’s beneficiaries receive the difference. Alternatively, if the policy is owned by a private corporation, up to the full amount of life insurance death benefit is available to be accessed through the corporation’s Capital Dividend Account.

Are There Any Downsides to an Immediate Financing Arrangement?

It’s critical that you seek professional advice to ensure that your personal situation is suited to such an arrangement. It is also important to ensure that it is created and executed in exactly the right way in order to perform successfully.

If you are interested in the benefits that an IFA can offer you and/or your business, please contact us directly. We will work with you to analyze the potential effectiveness of this strategy and determine if it is a viable solution for you.

Take the Next Step

Our team in Nanaimo has acquired decades of experience specializing in providing quality financial advice in areas of financial planning, investments and insurance. Book a meeting with us to learn how we can help you with your finances.